How to effectively protect your family and ensure the continuity of your assets?

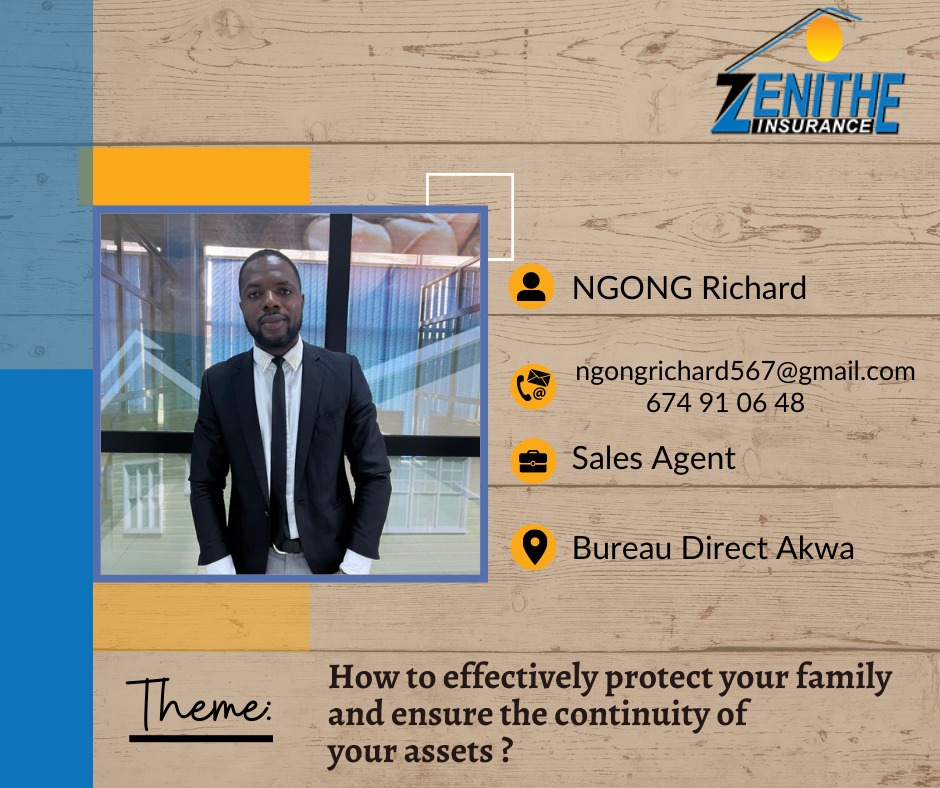

Industrious, perseverant and dynamic are some of the words that describe Richard NGONG. A hard worker, he is one of those collaborators that at Zenithe Insurance we are happy to have in our ranks. He is a good listener, helpful and has an unfailing smile. It is safe to say that he is a sales agent who is not only interested in making a profit, but in offering at each policyholder the insurance solution(s) that best suit their profile and needs. Based on his experience, today he discusses with us the question of how to effectively protect one's family and ensure the continuity of one's assets

What fears do Head of households face on a daily basis ?

The fears of every head of household rests on the ability to guarantee and secure a great future for their kids. Given the unsecured environment in which we live in today and the financial consequences resulting from damages our kids are exposed to, these fears are increasingly unavoidable and only by way of taking out a Head of Household Civil Liability Insurance with Zenithe Insurance S.A can you at least avoid or reduce this daily fear.

Nowadays, there are more and more disputes between neighbours. How can the Civil Liability insurance for the head of the family help to avoid them or at least to reduce the consequences ?

80 % of the disputes encountered nowadays between neighbours are caused either by their kids or pets. Indeed, no one is immune from risks, a lack of attention, or carelessness may lead to damage on others. Similarly, no one can be certain that one’s children, pets, etc will not cause damage to others. The purpose of head of household civil liability insurance is to cover the financial consequences resulting from damages caused to others by you, your kids or your pets

How can Head of Household Liability insurance help heads of household in their daily role ?

In everyday life, one can in one way or the other cause an injury to someone or destroy their properties. The consequences of such damages can be financially heavy. It is therefore advisable to take out Head of Household Civil Liability Insurance so that if the financial consequences befalls you, your insurer will take up your role as head of household by paying off these unforeseen expenses.

Is this insurance accessible to all ?

Head of household civil liability Insurance is recommended, even though you do not have children or pets; or even though you do not ride a bike. Indeed, everyone who lives in a family or a household can benefit from this policy.

As head of household, it is important to take into consideration the unforeseen events that can impact your daily life and that of your property. Because you can never prevent or fully avoid risks, even if you feel capable of dealing with such eventualities, insurance remains the best way to deal with a loss. It is therefore necessary for you to be informed about the insurance policies that will allow you to deal with the various losses that may pose a threat to the peace of your family and the future continuity of your assets: The Head of Household Civil Liability extension guarantee included in a comprehensive home insurance policy covers you against financial losses due to damage caused by your domestic staff, as well as persons or pets under your responsibility.